Partner's ads

Financial Advisors in Birmingham

Interface Financial Planning

Birmingham, West Midlands, West Midlands, B20 1JB

Financial Planning is not the end but only the means to the end. It's tragic when some people have spent years climbing up their ladder only to find that it's leaning against the wrong wall! Time must

CountryWise Finance

Birmingham, West Midlands, West Midlands, B16 8QG

Having an established track record of 37 years experience in the financial services industry, we have the expertise in the areas of mortgages, loans, insurance and managing your general finances.

Ghl Direct

Birmingham, West Midlands, West Midlands, B43 7QX

Property advice can help you make sense of the many different home loans & accompanying products available today. Our advisors can guide you through which mortgage is best for you, whether it is an

aFinancial, Mortgages Made Simple

Birmingham, West Midlands, West Midlands, B1 2HF

We can also provide access to some exclusive deals which are only available to Openwork and their advisors. Not all mortgages and loans are the same. Many deals quoted on comparison sites won't tell

KLO Financial Services

Birmingham, West Midlands, West Midlands, B3 1RB

We offer effective solutions for all aspects of financial planning. Our extensive experience in advising individual and corporate clients, as well as charitable trusts and professional trustees,

All Counties Financial

Birmingham, West Midlands, West Midlands, B1 1BD

We offer non investment protection products e.g. term assurance, income protection and critical illness from a range of insurers. We aim to get you the most cost effective policy without compromising

Store Financial Services

Birmingham, West Midlands, West Midlands, B3 2HJ

StoreFinancial is an international payment systems processor, programme manager and an industry leader in prepaid card programmes specifically designed for unaffiliated retailer groups. Currently,

Everyday Financial Solutions

Birmingham, West Midlands, West Midlands, B9 4AN

Everyday are award winners for our customer service! We are the most recent winner of the Best Customer Retention Performance at the Legal & General Business Quality Awards 2012. This award recognises

Invoice Finance Answers

Birmingham, West Midlands, West Midlands, B11 1SH

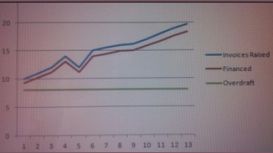

The terms Invoice Finance and Invoice Financing are synonymous and used inter-changeably. For as long as there has been trade, businesses have had to wait to be paid. For the last 400 years or so,

Coton Financial Management

Birmingham, West Midlands, West Midlands, B23 6TP

We specialise in providing independent financial advice for those approaching retirement or who are already retired. Coton Financial Management have been offering tailored independent financial advice

Can't find your business?

Adding a business to FinancialExpertAdvisors.co.uk is free.Frequently Asked Questions and Answers

- Click here to navigate to the Login page.

- If you haven't yet registered, click here to navigate to the Registration page.

- Fill all required fields.

- After you have logged in, click on "Add Business.

- After you have clicked on "Add Business", you will be redirected to another page.

- You can now fill in the details for this Business.

- Click on the "Create" button.

- Your listing will now be "pending approval".

- One of our Administrators will review your listing and decide whether to Approve or Reject it.

- Priority listing positioning for city, county, in the search results, and our home page.

- A website link on the listing page.

- Can add services with links included.

- Have access to all submitted free quotes from our visitors.

- Increase leads that you can follow up and generate sales from.

- Increase your online presence which, these days, is an indispensable commodity.

- Allow the thousands of potential customers who use the directory each month to find you.

Most of the usual clients of a financial advisor in Birmingham would be either owners of a business, people, who are about to invest in a new startup business or an idea they have in mind, or even older folks planning their retirement. It is usually in front of a big decision or a change we have to make in our lives when we need the help of a financial advisor in Birmingham to help us get on the right pat. However, nowadays the clientele of a financial advisor in Birmingham is getting more and more variable. People from different walks of life, different age groups, and different plans and priorities would enjoy and need the help of a financial advisor in Birmingham. A financial advisor in Birmingham is the professional who is trained in helping others gain the financial culture and knowledge they need according to the place in life they are at and where they want to go, what they want to achieve. A financial advisor in Birmingham is the person you go to, when you want to make the right steps. Therefore, today we would like to share with you some key tips you can get from a reputable financial advisor in Birmingham.

Tip from a Financial Advisor in Birmingham: Take Bigger Risks

You are maybe thinking that a financial advisor in Birmingham in their right state of mind would never advise you on taking risks. However, the good financial advisor in Birmingham knows that risks, when the right ones and at the right time, can bring back some great returns in investment and dedication. A financial advisor in Birmingham would encourage the younger clients to take bigger risks, because this is the right time for them to learn to walk and be brave to achieve their goals.

Tip from a Financial Advisor in Birmingham: Invest in Yourself

Another important tip from a financial advisor in Birmingham you would get is that no matter your age, investing in yourself in a great thing and it will pay off for sure. Especially when investing into improving a set of skills, developing a talent, learning something new or educating yourself, a financial advisor in Birmingham will tell you it is all worth it for sure. The single best investment you can make, especially while you are young, is investing in yourself, as a reliable and reputable financial advisor in Birmingham won’t get tired to tell you.

Tip from a Financial Advisor in Birmingham: Follow Opportunities

Like literary, a good and experienced financial advisor in Birmingham can also suggest that literary following the great opportunities is so important. Especially while you are young and carefree, you can easily move out the town, follow you dreams, don’t be afraid to go out of your comfort zone. A reputable and experienced financial advisor in Birmingham knows that there is a geography of success. For example, if you live in a small town with less opportunities, but you dream big, a financial advisor in Birmingham would suggest you don’t have to be afraid to move out and give yourself the chance to try new and exciting opportunities. Take it from a good financial advisor in Birmingham and allow yourself all chances.